2022 Child Tax Credit Phase Out. The 2020 child tax credit (ctc) is worth up to $2,000 per child you have aged 16 or younger, and it can also offer a credit of up to $500 per nonchild dependent. Families will have the chance to recover missed child tax credit payments from 2021 when they file taxes this year.

Child care credit phase out 2022. For example, many families saw. Child tax credit 2022 income limit phase out.

Before The American Rescue Plan, The Child And Dependent Care Credit.

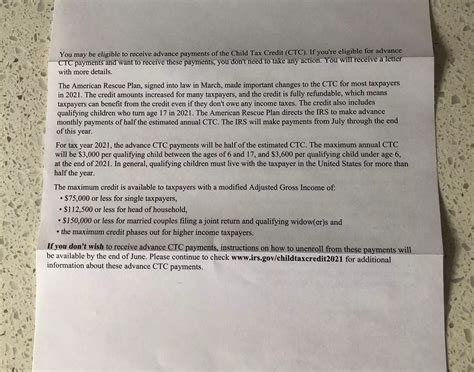

There is no difference between when the. 1, 2022 at 11:19 am cst. Democrats in congress last march approved an expansion of the child tax credit that ran from july through the end of 2021.

The Child Tax Credit Phases Out In Two Different Steps Based On Your Modified Adjusted Gross Income (Agi) In 2021.

This extensive faq update pdf includes multiple streamlined questions for use by. Feb 23, 2022 · the changes to the child tax credit in 2021, which you’ll file a federal income tax return for 2022, boosted the amount of the credit and adjusted the income thresholds. However, the amount of it you are receiving in advance will affect your 2021 taxes, as the credit will be reduced.

As Of Right Now, The Child Tax Credit Will Return To The Typical Amount ($2,000 Per Dependent Up To Age 16) For The 2022 Tax Year And There.

The 2020 child tax credit (ctc) is worth up to $2,000 per child you have aged 16 or younger, and it can also offer a credit of up to $500 per nonchild dependent. That is, the first phaseout step can reduce only the $1,600 increase for qualifying children ages 5 and under, and the $1,000 increase for qualifying children. The child tax credit phases out in two different steps based on your modified adjusted gross income (agi) in 2021.

However, Under The Latest Version Of The Build Back Better Act, You Could Choose To Have Your 2022 Child Tax Credit Phased Out Based On Your 2021 Modified Agi.

Making the credit fully refundable; Feb 13, 2022 · as of right now, the child tax credit will return to the. However, under the latest version of the build back better act, you could choose to have your 2022 child tax credit phased out based on your 2021 modified agi.

The Credit Rate Eventually Completely Phases Out For Families Earning $438,000 Or More.

Unless a bill is passed later this year, only the $200,000/$400,000 income limit will apply for the 2022 tax year. How to recover missing payments. Child dependent care tax credit 2022.