2022 Dc Tax Brackets. $5,092 plus 32.5c for each $1 over $45,000. 10% tax rate for incomes less than $10,275;

Married individuals filling joint returns; Sales and use tax table at 6% rate [pdf] other taxes Here is a look at what the brackets and tax rates are for 2021 (filing 2022):

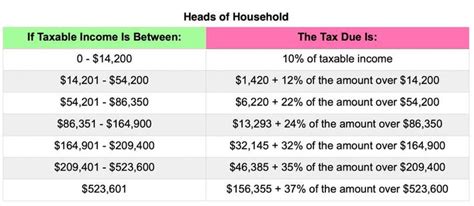

2021 Tax Brackets And Rates For Single Filers, Married Couples Filing Jointly, And Heads Of Households;

2020 district of columbia tax brackets and rates for all four dc filing statuses are shown in the table below. The 2022 tax brackets for single filers. The district of columbia state sales tax rate is 5.75%, and the average dc sales tax after local surtaxes is 5.75%.

Review The Current 2021 Tax Brackets And Tax Rate Table Breakdown.

$51,667 plus 45c for each $1 over $180,000. The income tax system in washington dc is a progressive tax system. Single $12,950 n/a n/a head of household.

In 2022, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

Income tax if taxable income is over but not over the tax is of the amount over; Find previous tax year or back tax brackets and income tax rate tables. There are still seven brackets broken up by income.

Not Over $10,000 4% Of The Taxable Income

The tax rates for tax years beginning after 12/31/2015 are: The district of columbia income tax has six tax brackets, with a maximum marginal income tax of 8.95% as of 2022. Domestic company higher tax threshold in 2022:

2022 Federal Income Tax Rates:

Head of household tax brackets married filing jointly or qualifying widow tax brackets married filing separately tax brackets 10%: 10 percent, 12 percent, 22 percent, 24. The associated state tax rates or brackets vary by state.