2022 Graduated Tax Brackets. Key findings particular person revenue taxes are a significant supply of state authorities income, accounting for 36 % of state tax collections in fiscal yr 2020, the newest yr for which knowledge can be found. That's nice of the irs, but at the end of the day, the government still wants our money!.

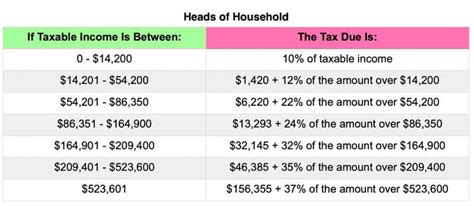

There are four filing statuses and seven graduated tax rates for 2021 taxes due on april 15, 2022. The more you make, the more you pay. Here are the new brackets for 2022, depending on your income and filing status.

Here Are The New Brackets For 2022, Depending On Your Income And Filing Status.

Key findings particular person revenue taxes are a significant supply of state authorities income, accounting for 36 % of state tax collections in fiscal yr 2020, the newest yr for which knowledge can be found. There are seven tax brackets in all. But as you contemplate gathering receipts and tax records for 2021, the irs is at work adjusting tax brackets for 2022.

Tax System Uses A Graduated Scale, Meaning You Pay Different Percentages On Your Taxable Income.

The 2022 income tax brackets and standard deductions are out! The more you make, the more you pay. Imposes tax on income using graduated tax rates, which increase as your income increases.

The Bracket Adjustment Amount Starts At $610 For Individuals With Net Income Of $84,501 And Decreases By $10 For Every $100 In Additional Net Income.

26% on the portion of taxable income over $98,040 up to $151,978 and. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. Your bracket is determined by how much taxable income you receive each year and your filing status.

20.5% On The Portion Of Taxable Income Over $49,020 Up To $98,040 And.

Although the actual income tax brackets have not changed, the taxable income range per tax bracket has adjusted upward slightly to account for inflation. The new income tax rates from year 2023 onwards, as per the approved train tax law, are as follows. The top tax rate for individuals is 37 percent for taxable income above $539,901 for tax year 2022.

The More You Make, The More You Pay.

Federal tax bracket rates for 2022. Income tax rate (year 2023 onwards) p250,000 and below. For example, a single taxpayer will pay 10 percent on taxable income up to $9,950 earned in 2021.