2022 Tax Brackets Adjusted For Inflation. The irs said the income thresholds for federal tax brackets will be higher in 2022, reflecting the faster pace of inflation. The tax rates themselves didn't change from 2021 to 2022.

Because of this change, it is possible you could be in a different tax bracket for 2022, even if your income has remained the same. However, the tax brackets are adjusted (or indexed) each year to account. The tax rates themselves didn't change from 2021 to 2022.

For 2022, They're Still Set At 10%, 12%, 22%, 24%, 32%, 35% And 37%.

However, the tax brackets are adjusted (or indexed) each year to account. 2022 tax brackets and rates. What are the 2022 adjusted tax brackets?

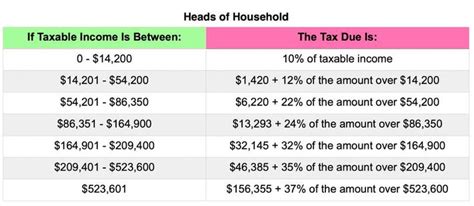

Here’s A Look At The Breakdown Of The Marginal Rates For 2022:

37% for incomes over $539,900 ($647,850 when filing jointly) 35% for incomes over $215,950 ($431,900 when filing jointly) 32% for. The internal revenue service (irs) just released updated information about the tax brackets for 2022. 2022 individual tax rates and income brackets you will use these tax rates and income brackets when completing your 2022 tax return to be filed in 2023.

37 Percent For Income Greater Than $13,450;.

To set the tax brackets for 2022, the irs used inflation from september 2020 through august 2021, resulting in a 3% adjustment, even. The limitation on the §179d deduction for energy. Two republican legislators say a bill they have introduced will reduce the effects of income tax “bracket creep”.

2022 Income Tax Brackets For 2022, The Highest Income Tax Bracket Of 37 Percent Applies When Taxable Income Hits:

Irs announces tax brackets and other inflation adjustments for tax year 2022 the 2022 standard deduction for married filing jointly is $25,900 In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). The new brackets have been adjusted for inflation, which has spiked up drastically during the pandemic.the 2022 income tax brackets will have the largest increase since congress totally revamped the tax code in 2017.

Because Of This Change, It Is Possible You Could Be In A Different Tax Bracket For 2022, Even If Your Income Has Remained The Same.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. As we have already discussed, you can adjust for inflation by dividing the data by the appropriate consumer price index and multiplying it by 100 in order to get a realistic rate. The income tax brackets for trusts and estates also increase in 2022 to the following: