2022 Tax Brackets Bc. Carbon tax cost up to 11 cents per litre of gasoline, 13 cents per litre of diesel and 10 cents per cubic metre of natural gas. A brief comparison of 2021 and 2022 are as follow:

British columbia income tax brackets and other information. For more detailed information on the personal amounts, go to form td1bc, 2022 british columbia personal tax credits return. Your average tax rate is 20.8% and your marginal tax rate is 33.8%.this marginal tax rate means that your immediate additional income will be taxed at this rate.

96 866,01$ To 117 623$.

2022 british columbia tax rate cards for individuals and corporations. Once your taxable income is determined, which equals all sources of income minus applicable deductions, reductions, and credits, you can find where. British columbia income tax brackets and other information.

If You Make $52,000 A Year Living In The Region Of British Columbia, Canada, You Will Be Taxed $10,804.That Means That Your Net Pay Will Be $41,196 Per Year, Or $3,433 Per Month.

117 623,01$ to 159 483$. This will bring the b.c. 22 rows the federal tax brackets and personal tax credit amounts are increased for 2022 by.

British Columbia’s Carbon Tax Is Set To Rise To $50 Per Tonne On April 1, 2022.

For instance, emma’s 2021 and 2022 taxable income remains. Federal indexing factors, tax bands, and tax rates have been confirmed by the canada revenue agency (cra). Provincial income tax brackets for tax year 2021.

For The 2022 Tax Year, The Tax Brackets Were Increased From The Previous Year By A Bc Cpi Rate Of 2.1%.

The tax brackets are indexed each year to the consumer price index for b.c. Carbon tax cost up to 11 cents per litre of gasoline, 13 cents per litre of diesel and 10 cents per cubic metre of natural gas. A brief comparison of 2021 and 2022 are as follow:

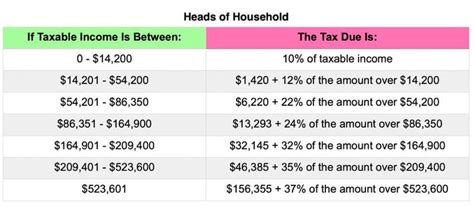

10 Percent, 12 Percent, 22 Percent, 24 Percent, 32 Percent, 35 Percent, And 37 Percent.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. Tax bracket 2022 tax rate 2022 b.c. Sbd corporate tax rate reduces from 2% to 1% on jan 1, 2022 2.