2022 Tax Brackets Changes. After the standard deduction, or other itemized deductions and tax breaks have been taken, here's how your income will be taxed. National insurance rates are set to rise by 1.25 percentage points from 6 april 2022, as part of the government’s plan to introduce a health and social care levy where working people contribute to.

Tax rates not changed, but brackets increase. After the standard deduction, or other itemized deductions and tax breaks have been taken, here's how your income will be taxed. In order to keep up with inflation, tax brackets are adjusted.

Five States (Arizona, Arkansas, Louisiana, North Carolina, And Oklahoma) Cut Individual Income Taxes Effective January 1.

The 2022 standard deduction amounts are as follows: This report will highlight the tax changes in 2022 and provide cost estimates for increases to payroll taxes, such as canada pension plan and employment insurance contributions, and bracket creep. The district of columbia was the only jurisdiction to increase income taxes.

The 2018 Budget Announced A Number Of Adjustments To The

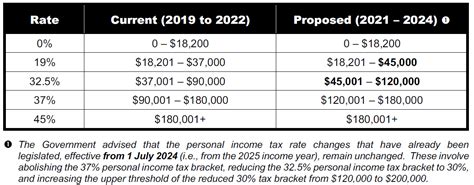

However, the tax brackets have been adjusted to account for inflation. National insurance rates are set to rise by 1.25 percentage points from 6 april 2022, as part of the government’s plan to introduce a health and social care levy where working people contribute to. This tax table reflects the last amended tax brackets from as at 6 october 2020.

National Insurance Threshold And Rate Changes.

There are seven federal tax brackets: Taxable income up to $20,550 (up from $19,900 for 2021) 10%, 12%, 22%, 24%, 32%, 35% and 37%.

After The Standard Deduction, Or Other Itemized Deductions And Tax Breaks Have Been Taken, Here's How Your Income Will Be Taxed.

Marginal tax rates for 2022 will not change but the level of taxable income that applies to. Bracket creep happens when governments don’t move tax brackets with inflation and inflation automatically bumps As mentioned, income tax brackets were raised again because of inflation rates, as were other tax deductions like the earned income tax credit (eitc).

For Single Taxpayers And Married Individuals Filing Separately, The Standard Deduction Rises To $12,950 For 2022, Up $400, And For Heads Of Households, The Standard Deduction Will Be $19,400 For Tax Year 2022, Up $600.

Tax rates will remain the same at 10%, 12%, 22%, 24%, 32%, 35% and 37%. For the 2022 tax year, the irs bumped up the income thresholds for all filing statuses to account for inflation. For married individuals filing jointly: