2022 Tax Brackets Georgia. In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Subtract the nontaxable biweekly federal health benefits plan payment from the amount computed in step 1.

2022 georgia tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator. Looking at the tax rate and tax brackets shown in the tables above for georgia, we can see that georgia collects individual income taxes differently for single versus married filing statuses, for example. Georgia utilizes a relatively simple progressive income tax system, with rates ranging from 1.00% to 5.75%.

The Federal Corporate Income Tax, By Contrast, Has A Marginal Bracketed Corporate Income Tax.georgia's Maximum Marginal Corporate Income Tax Rate Is The 10Th Lowest In The United States, Ranking Directly Below Missouri's 6.250%.

Any income over $7,000 for single would be taxed at the rate of 5.75%. Changes begin for individuals with a d.c. Those that are filing as.

Subtract The Nontaxable Biweekly Federal Health Benefits Plan Payment From The Amount Computed In Step 1.

In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). The irs also announced that the standard deduction for 2022 was increased to the following: Taxable income between $250,000 and $500,000, assessed a tax of $19,560 plus 9.25 percent of the excess over $250,000.

Georgia Plans To Spend $27.3 Billion In State Money Raised Through Taxes And Fees For The 2022 Fiscal Year.

An email was sent to email addresses on record when the tax. This is the lowest tax bracket 2021 in canada that is applicable to the income tax deductible of the individual or the business. 2022 georgia tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.

What Is The Married Filing Jointly Income Tax Filing Type?.

There are seven federal income tax rates in 2022: The money that individuals pay in tax annually to the government is then sent to their nearest social. The past ten years have witnessed a dramatic decrease of canadian tax rates.

Tax Brackets And Rates For The 2022 Tax Year, As Well As For 2020 And Previous Years, Are Elsewhere On This Page.

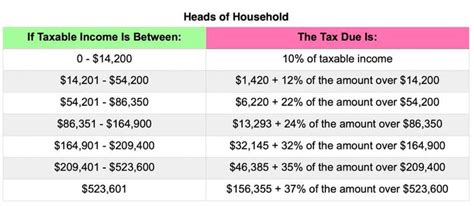

2021 federal income tax brackets (for taxes due in april 2022 or in october 2022. For example, if you are single and your taxable income is $75,000 in. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.