2022 Tax Brackets India. The one thing that the common man will be eagerly waiting to hear from the finance minister during union budget 2022 presentation is the announcement on taxation. 25% of income tax where total income exceeds rs.

Male and female individuals under 60 years of age and huf; Income between ₹ 5,00,001 and ₹ 7,50,000: As salaried class demand hike in itr bracket, check 10 options to save income tax other than 80c.

10,00,000 20% 20% Above Rs.

The tax rates haven't changed since 2018. You can see also tax rates for the year 202 1. Until now, the tax benefit was capped at 10% for state government and private sector employees.

Income Between ₹ 5,00,001 And ₹ 7,50,000:

Interest rates starting january 1, 2022, the interest rate for taxpayers with. As salaried class demand hike in itr bracket, check 10 options to save income tax other than 80c. The indian 2022 tax calculator is updated for the 2022/23 assessment year.

There Were Similar Tax Rate Cuts For Salaries Up To Rs 15 Lakh.

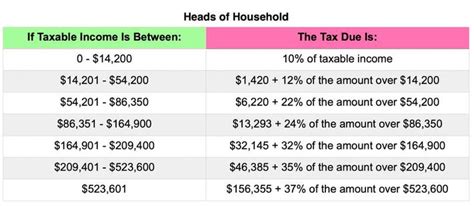

There were similar tax rate cuts for salaries up to rs 15 lakh. 2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below. New income tax slab, rate, changes for salaried employee, senior citizens, nris, 80c, 80d, nps, ppf, retirement, pension

Income Between ₹ 0 And ₹ 2,50,000:

India will begin levying a 30% tax on all income from cryptocurrency transfers, according to the country’s finance minister nirmala sitharaman. Income between ₹ 1,00,001 and ₹ 12,50,000: Male and female individuals under 60 years of age and huf;

You Can Calculate Your 2022 Take Home Pay Based Of Your 2022 Gross Income, Education Tax, Nis And Income Tax For 2022/23.

However, rates remained unchanged at 30 per cent for those above rs 15 lakh per annum. There will be two types of tax slabs. Income between ₹ 7,50,001 and ₹ 1,00,000: