2022 Tax Brackets New York State. The new york standard deductions did not increase for tax year 2021, thus use these 2020 values. New york state income tax brackets and income tax rates depend on taxable income and filing.

Under sb 159, and effective january 1, 2022, the top marginal income tax rate is reduced from 6.9% to 6.75%. Residents of new york state are subjected to income tax (4% to 10.9%) and state payroll taxes such as disability insurance (sdi) and paid family and medical leave (pfml). New york governor andrew m.

These Changes Apply To Payrolls Made On Or After January 1, 2022.

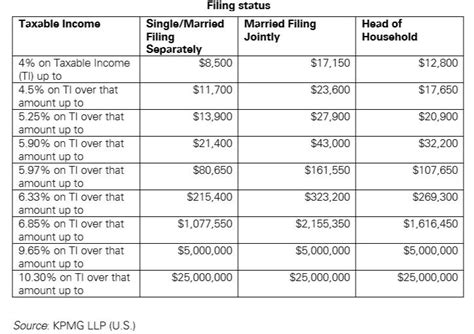

Filing jointly has many tax benefits, as the irs and many states effectively double the width of most mfj brackets when. Income tax brackets for other states: New york tax withholding rates.

New York State Tax Rate Schedule 2022.

The federal corporate income tax, by contrast, has a marginal bracketed corporate income tax.there are a total of twenty three states with higher marginal corporate income tax rates then new york. Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower 2022 tax brackets and rates in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

State Corporate Income Tax Rates As Of January 1, 2022;

Turbotax.intuit.com has been visited by 1m+ users in the past month. Married filing jointly is the filing type used by taxpayers who are legally married (including common law marriage) and file a combined joint income tax return rather than two individual income tax returns. If you want to simplify payroll tax calculations, you can download ezpaycheck payroll software, which can calculate federal tax, state tax, medicare tax, social security tax and other taxes for you automatically.

They Have Also Been Revised To Reflect Certain Income Tax Rate Increases Enacted Under Chapter 59 Of The Laws Of 2021 (Part A).

Compare state tax brackets, rates for your personal effective irs tax rate use the rateucator tool; Calculate 2022 new york state withholding tax. Income tax tables and other tax information is sourced from the new york department of taxation and finance.

New York State Income Tax Rates Are 4%, 4.5%, 5.25%, 5.9%, 5.97%, 6.33%, 6.85%, 9.65%, 10.3% And 10.9%.

2022 new york state and yonkers withholding tax tables have been updated. We revised the 2022 new york state personal income tax rate schedules to reflect certain income tax rate reductions enacted under the tax law. This page has the latest new york brackets and tax rates, plus a new york income tax calculator.