2022 California State Tax Brackets. Taxable income between $10,275 to $41,775. They are unemployment insurance (ui) and employment training tax (ett) , which are employer contributions, and state disability insurance (sdi) and personal income tax (pit) , which are withheld from employees'.

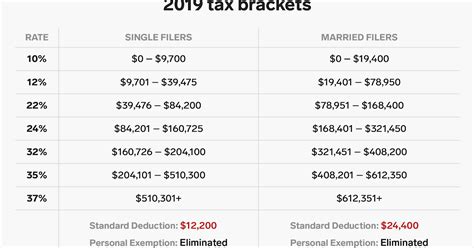

The last ten years has seen a sharp reduction for canadian tax rates. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. 2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below.

$19,400 For Tax Year 2022 2022 Tax Brackets (For Taxes Due In April 2023) Announced By The Irs On November 10, 2021, For Individuals, Married Filing Jointly, Married Filing Separately And Head Of Household Are Given Below.

10 percent, 12 percent, 22 percent, 24. Although how the brackets work the same, the tax rates are significantly different than the federal rates though. We also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state.

Taxable Income Between $89,075 To $170,050.

There are actually twelve states (along with the district of columbia) that levy an estate tax, and most have exemption amounts that are lower than the federal amount. 2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below. For 2022, the federal estate tax exemption is $12,060,000 and the top federal estate tax rate is 40%.

Nevertheless, An Increase Of About 3 Percent Is Expected For All Brackets.

California has nine tax brackets: The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. Taxable income between $10,275 to $41,775.

Taxable Income Between $250,000 And $500,000, Assessed A Tax Of $19,560 Plus 9.25 Percent Of The Excess Over $250,000.

2022 california state tax tables. An extra 1% may apply. The proposed constitutional revision (aca 11 2022) to the state tax code is projected to increase taxes by roughly $12,000 per household.

Taxable Income Up To $10,275.

Taxable income between $41,775 to $89,075. California has ten marginal tax brackets, ranging from 1% (the lowest california tax bracket) to 13.3% (the highest california tax bracket). What is the income tax rate in california?