2022 Tax Brackets Printable. For example, the 10 percent tax bracket applies to income up to $9,950 for single filers in 2021 tax brackets, whereas it was $9,700 for 2020. R7 794 r7 713 r7 479 r7 407 r7 407 r7 110 tertiary (75 and older) r2 871 r2 736

2022 federal tax tables printable. R14 067 r13 635 r13 500 r13 257 r12 726 secondary (65 and older) r8 613 r8 199: 2022 tax returns are due on april 15, 2023.

Then Taxable Rate Within That Threshold Is:

Calculate your income tax brackets and rates here on efile.com. $0 $10,275 $0 + 10.0 $0 $10,275 $41,775 $1,027.50 + 12.0 $10,275 $41,775 $89,075 $4,807.50 + 22.0 $41,775 $89,075 $170,050 $15,213.50 + 24.0 $89,075 $170,050 $215,950 $34,647.50 + 32.0 $170,050 $215,950. For example, the 10 percent tax bracket applies to income up to $9,950 for single filers in 2021 tax brackets, whereas it was $9,700 for 2020.

Tax Rate For Single Filers For Married Individuals Filing Joint Returns For Heads Of Households;

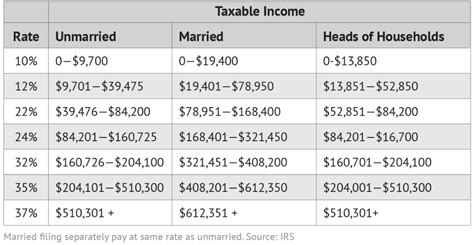

Click any of the irs 1040tt tax table links below to download, save, view, and print the file for the details: 10%, 12%, 22%, 24%, 32%, 35% and 37%. A 24% tax on the next section, up to $329,850;

Tax Brackets For Income Earned In 2022 37% For Incomes Over $539,900 ($647,850 For Married Couples Filing Jointly) 35% For Incomes Over $215,950 ($431,900 For Married Couples Filing Jointly)

A 22% on the portion going up to $172,750; Taxable income ($) base amount of tax ($) plus marginal tax rate of the amount over not over over ($) single. Irs income tax forms, schedules and publications for tax year 2022:

For The 2022 Tax Year, There Are Also Seven Federal Tax Brackets:

This difference is going to be higher for the 2022 tax season as the inflation is higher and more visible as the department of labor announced the consumer price index is the highest since 2008. Income tax rate the local income tax is computed without regard to the impact of the state tax rate. Married filing jointly or qualifying widow (er) 10%.

2017 2016 2015 Primary R15 714 R14 958 R14 220:

Tax rebate tax year 2022: Income tax brackets and rates in 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). A 10% tax on the first $20,550;