2022 Tax Brackets Publication 15. The irs publication 15 includes the tax withholding tables. The fixed exemption amount is to be $12,900 for those married filing jointly;

15, employer's tax guide, and pub. Using the chart, you find that the “standard withholding” for a single employee is $176. Draft federal income tax withholding tables for 2022 were issued nov.

Your Tax Bracket Is Determined By.

Where the tax is determined under the alternative minimum tax provisions (amt), the above table is not applicable. 0.33 percent for taxable income between $0 and $1,743; The rates do not include the ontario health premium (see note 5 below).

You Find That This Amount Of $2,025 Falls In The “At Least $2,020, But Less Than $2,045” Range.

The fixed exemption amount is to be $12,900 for those married filing jointly; It describes how to figure withholding using the wage bracket method or percentage method, describes the alternative methods for figuring withholding, and provides the tables for withholding on distributions of indian gaming profits to tribal members. A new withholding worksheet was added to the automated percentage method.

Orion Planning Incorporates The Secure Act, Changing Rmd Age From 70 1/2 To 72, And The Ability To Contribute To A Traditional Ira Past 70 1/2 If Still Working.

The irs publication 15 includes the tax withholding tables. 2022 income tax withholding tables and instructions for employers. Draft federal income tax withholding tables for 2022 were issued nov.

2022 Federal Tax Tables With 2022 Federal Income Tax Rates, Medicare Rate, Fica And Supporting Tax And Withholdings Calculator.

For the 2022 tax year, there are also seven federal tax brackets: $5.75+.67 percent for taxable income between $1,743 and $3,486; Irs income tax forms, schedules and publications for tax year 2022:

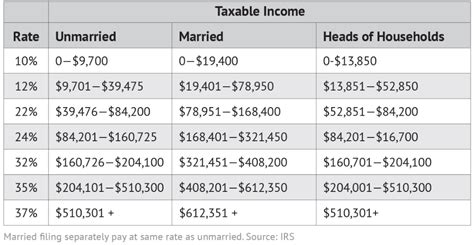

2022 Tax Brackets And Rates In 2022, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

Under sb 133 and effective in 2022, each county is authorized to set by ordinance or resolution, a county income tax rate equal to at least 2.25% (previously, 1%) and to apply the county income tax on a bracket basis. The tax rates include the provincial surtaxes and reflect budget proposals and news releases up to january 15, 2022. 51, agricultural employer’s tax guide.