2022 Tax Brackets Putnam. The tax brackets on the front of this flier for tax year 2022 apply to tax returns filed in 2023, and the annual adjustments that the irs made to these brackets are higher than usual—roughly 3% for most brackets—because inflation rose in 2021. Taxable income between $89,075 to $170,050.

Maximum compensation subject to fica taxes oasdi (social security) maximum $142,800 hi (medicare) maximum no limit oasdi and hi tax rate: The 2022 financial year starts on 1 july 2021 and ends on 30 june 2022. Federal tax bracket rates for 2022.

Every Year The Irs Modifies The Tax Brackets For Inflation.

Below you will find the 2022 tax rates and income brackets. The following are the federal tax rates for 2022 according to the canada revenue agency (cra): To access your tax forms, please log in to accounts.

6.2% And 1.45% (7.65% Combined) For Employees.

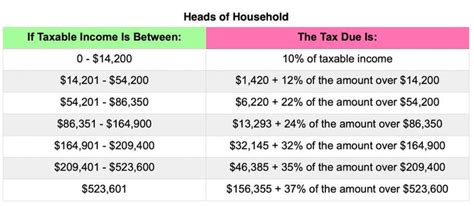

The tax brackets on the front of this flier for tax year 2022 apply to tax returns filed in 2023, and the annual adjustments that the irs made to these brackets are higher than usual—roughly 3% for most brackets—because inflation rose in 2021. There are seven federal income tax rates in 2022: For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing jointly).

Taxable Income Between $41,775 To $89,075.

Putnam’s “2022 tax rates, schedules, and contribution limits”. 10%, 12%, 22%, 24%, 32%, 35% and 37%. 19c for each $1 over $18,200.

There Are Seven Federal Tax Brackets For The 2022 Tax Year:

$51,667 plus 45c for each $1 over $180,000. A first step for investors in tax planning for the year ahead is to determine their tax bracket. 2022 tax brackets and rates in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

A First Step For Investors In Tax Planning For The Year Ahead Is To Determine Their Tax Bracket.

A first step for investors in tax planning for the year ahead is to determine their tax bracket. Putnam’s “2022 tax rates, schedules, and contribution limits” can be a useful reference to review with a financial advisor. 2021 tax brackets and rates for single filers, married couples filing jointly, and heads of households;