Igor Kutyaev/iStock by means of Getty Photos

By David Baskin

Annus Horribilus

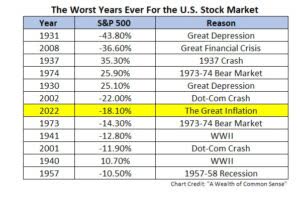

I was shocked to locate that it is currently three decades given that the late Queen Elizabeth II utilized this unforgettable expression to identify an especially terrible year for her household. Possibly we need to make use of the epithet moderately, waiting for genuinely terrible years, however also if we do, 2022 fits the costs. As the graph listed below programs, it conveniently makes the leading 10 listing for poor stock exchange returns:

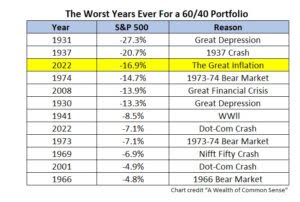

Neither existed any type of alleviation for those that expanded their profiles by placing 40% right into the typical safe-haven property, bonds. A profile of 60% supplies as well as 40% bonds shed 16.9% in 2022, the 3 rd worst efficiency ever before for such a profile, as well as the most awful return in the article The second world war period.

There are certainly a variety of well-understood reasons that 2022 was such a poor year for financiers. The major ones:

- The proceeding COVID pandemic which, without much excitement, eliminated around 12,000 Americans as well as 600 Canadians monthly in 2022. Regarding 1,100,000 Americans have actually passed away from the illness.

- The interruption in international profession emerging from regular lockdowns in China, which roiled supply chains as well as created lacks of essential products as well as ended up items basically almost everywhere.

- The battle in Ukraine, currently without a doubt Europe’s a lot of vicious as well as damaging battle in the last 75 years.

- The choice by main lenders in The United States and Canada as well as Europe to combat rising cost of living via fast rises in rate of interest, triggering rates for bonds to collapse.

- Reversion to the mean for supplies. Out-sized gains in 2020 as well as 2021 had actually created the rates for several supplies to climb over their essential worth; a go back to even more typical metrics in this instance is not really unanticipated.

Looking in reverse is a lot easier than projecting. We can, in retrospection, see precisely what occurred in 2015, as well as we can offer all type of reasons that. Presuming what is mosting likely to occur this year is a lot harder. The globe is just as well complicated, as well as all forecasts for the future are by their nature, very unclear. That being stated, we are going into 2023 with some positive outlook, for the complying with factors.

- We assume forecasts of a deep economic downturn in 2023 are over-blown. We see significant toughness in the work markets in both Canada as well as the United States, with joblessness prices really reduced, as well as work openings remain to surpass the variety of out of work individuals. Canada is boosting migration to aid companies locate certified team; this is not something that occurs in a diminishing economic situation. Furthermore, it is necessary to bear in mind that the stock exchange as well as the economic situation are 2 really various points. It is never uncommon to see the stock exchange breakthrough also as the economic situation delays. The marketplaces are leading signs as well as will certainly typically rise equally as financial problems seem at their worst.

- Customers maintain paying their home mortgages, vehicle loan as well as bank card financial obligation. Although rate of interest have actually climbed regarding 4%, there are couple of indications of distress as well as the percentage of finances that remain in default is near a document low. The majority of customers conserved cash throughout both years in which COVID limited costs on traveling, home entertainment as well as recreation, as well as these funds are readily available for financial obligation settlement. There is no indicator of a situation in the real estate markets, although sales have actually slid as well as rates are down about 10% to 15%, depending upon the marketplace. Offered the massive upswing in rates in the previous couple of years, this is rarely shocking.

- Rates for a few of the most effective business on the planet are currently really eye-catching. As an example, Amazon.com (AMZN), Apple (AAPL), Google (GOOG, GOOGL) as well as Microsoft (MSFT), the supposed “huge technology” business are all trading well off their degrees of a year earlier. They all continue to be very lucrative. The majority of the Canadian financial institutions as well as insurer are likewise at really low cost, offered their revenues as well as returns. Background reveals that the moment to acquire fantastic business is when they are undesirable. The stock exchange stays the only location on the planet in which individuals are better to acquire points when their rates are high, not reduced. Dollar the pattern. Purchase reduced.

- Dividends paid by our profile business climbed dramatically throughout the year. This is great information for a variety of factors. Initially, reward settlements develop a vital part of the financial investment return, as well as especially so in years in which supply rates are down. Second, unlike supply rates which fluctuate everyday, returns are substantial. They can be invested, as well as they can sustain a way of life. Ultimately, as well as most significantly, when a business increases its reward it is informing its investors that it is certain regarding the future. No firm ever before suches as to reduce a returns, so boosts come just after difficult idea as well as conversation by the firm’s Board. Throughout 2022, of our 38 dividend-paying business, no less than 34 increased their returns, generally, by 9.1%.

- Over the previous 4 years, we have actually inhibited our customers from spending as well greatly in set revenue. The returns were just as well reduced, with financial investment quality bonds paying just around 2.5%. Currently points have actually altered as well as returns in the 5% variety are readily available. With these brand-new greater rate of interest, we have the ability to lower threat in profiles as well as secure affordable returns over the brief to midterm. The terrible bond market in 2022 was a when in a life time sensation which will certainly not be duplicated in 2023.

- Ultimately, we are seeing a really welcome decrease in the massive quantities of conjecture that were a function of the marketplace in the previous 3 years. From cryptocurrencies to Unique Objective Procurement Business (SPACs) to over-hyped brand-new market participants like Beyond Meat (BYND) as well as Peloton (PTON), fantastic quantities of cash have actually been made as well as shed simply put amount of times. The overall worth of all cryptocurrencies came to a head at $3.1 trillion in 2015. It is currently listed below $800 billion, down around 75%. Beyond Meat supply came to a head at $235 as well as is currently $13. Peloton struck a high of $163 as well as is currently $9. Much less conjecture benefits our customers, as even more cash obtains guided to basically appear, lucrative business, which is what we acquire.

Throughout 2021 as well as very early 2022 I bear in mind discussions with several customers in which we revealed our shock at the fantastic outcomes we were seeing, also despite COVID as well as issues in globe profession. Unfortunately, in 2022 we returned a great deal of the gains we made in 2021. Nevertheless, after among the most awful market years in living memory, a lot of customers will certainly locate that in the two-year duration from Dec. 31, 2020, to Dec. 31, 2022, their profiles are basically level. It might not be fantastic, however it’s not truly terrible, either.

Everyone at Baskin Wide range Administration want you a satisfied, healthy and balanced as well as lucrative brand-new year.

Original Article

Editor’s Note: The recap bullets for this post were selected by Looking for Alpha editors.