Olivier Le Moal

Financial coverage remained within the highlight in September with the European Central Financial institution’s (ECB) unprecedented 75-basis level (bp) hike. Broadly anticipated, the market had a muted response, other than the euro getting again to parity with the U.S. greenback. The ECB’s hawkish shift is clearly an effort to stop power and commodities inflation from changing into embedded in home costs, even when it means dampening demand. Apparently, the ECB signaled extra hikes amid substantial upward revision of its actual GDP projection for 2022.1 However markets appeared unclear on what the ECB meant when in the identical assertion the financial institution restated its data-dependent, meeting-by-meeting strategy. The contrasting statements resulted in a impartial response from the market.

The ECB up to date its financial projections from July with vital downward revisions for progress and upward revisions for inflation. The ECB now forecasts actual GDP to develop 3.1% in 2022, 0.9% in 2023, and 1.9% in 2024, and inflation to common 8.1% in 2022 earlier than step by step normalizing to five.5% in 2023 and a pair of.3% in 2024. An important takeaway was ECB President Christine Lagarde stressing that the inflation forecast for 2024 stays above the two% goal, which can result in a number of giant price hikes.2 The silver lining is that these projections don’t sign recession within the area, however reasonably a low-growth, high-inflation situation, i.e., stagflation.

The Federal Reserve (Fed) remained aggressive with its third consecutive 75bp hike, and we anticipate the 75bp hikes to proceed till core inflation, which excludes meals and power, begins abating. Fed Chair Jerome Powell mentioned that he’s prepared to tolerate a recession if that’s what it takes to regain management of inflation.3 Treasury Secretary Janet Yellen mentioned that whereas the economic system’s progress price was slowing, the labor market remained “exceptionally sturdy” with nearly two vacancies for each employee searching for a job.4 Her assertion echoed the better-than-expected ISM manufacturing studying for August. Even when the Fed stays hawkish within the close to time period, we don’t anticipate the cycle to proceed past spring 2023.

The worldwide economic system is firmly in transition as a consequence of this difficult macroeconomic atmosphere, the resultant coverage responses, and the structural adjustments pushed by the unfolding power disaster. Nevertheless, we see a number of causes for optimism.

Funding methods highlighted this month:

- Tech Rebound Doable with a Extra Steady U.S. Greenback – Additional normalization of headline inflation and aggressive financial tightening in different areas ought to preserve the U.S. greenback comparatively secure, which bodes effectively for expertise firms and different growth-oriented names.

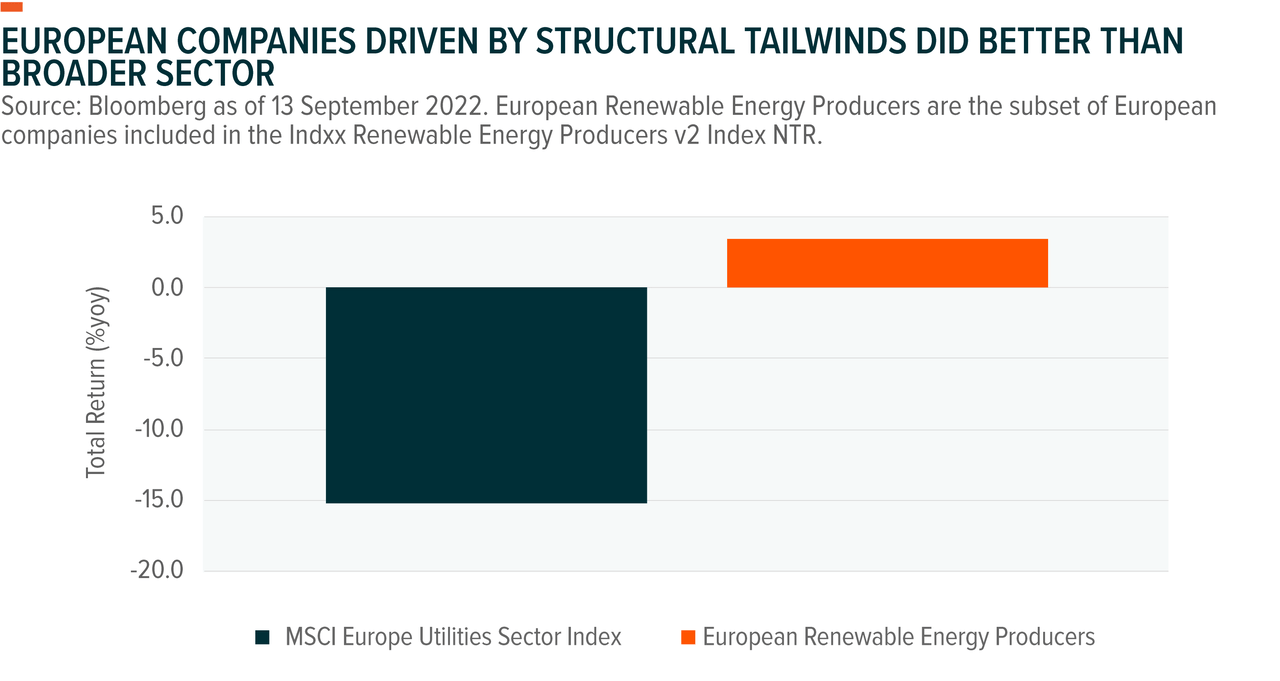

- European Corporations Supported by Structural Drivers Outperforming – The worldwide power disaster will possible make local weather change an important mega theme of the last decade, and we’re beginning to see it play out in efficiency.

- Silver Miners Current Alternatives – Engaging valuations for silver miners, excessive pessimism on silver futures, and a excessive gold-to-silver ratio level to a attainable rebound.

Tech: A Extra Steady U.S. Greenback Can Assist

Know-how firms have been hit onerous in 2022, and the short-term state of affairs seems daunting. Nevertheless, long-term digitalization developments proceed to materialize into a significant structural shift, and we are able to determine key macroeconomic causes for investor sentiment in the direction of progress methods to show extra optimistic. First, headline inflation might have peaked within the U.S., and second, the U.S. greenback appears to be like poised to stabilize amid slowing financial progress. A extra secure greenback can be optimistic for the Know-how sector on condition that a lot of its greatest names conduct giant parts of their enterprise abroad. Nvidia and Meta, for instance, have misplaced half their worth this yr amid excessive inflation and price hikes.5

The fed funds price is at 3.25% and the ECB’s important refinancing operations (MRO) price, which is the rate of interest banks pay once they borrow cash from the ECB for one week, is now at 1.25%. Present fed funds futures pricing means that the fed funds price will improve by about 119bp by year-end, presumably with one other 75bp hike in November, adopted by a 50bp hike in December.6 In Europe, markets anticipate the ECB to hike by about 136bp by year-end, presumably with 75bp and 50bp hikes in October and December, respectively.7

Importantly, the Fed and the ECB are anticipated to extend charges by the identical quantity from October, and thus preserve the present price differential, which shouldn’t drive additional greenback appreciation. As of September 22, the DXY Index, which tracks the power of the greenback versus main currencies, was over 16.7% greater this yr, reaching its highest level since 2002.8 Nevertheless, slowing financial progress and aggressive tightening from different main central banks are more likely to improve downward pressures on the greenback.

For U.S. equities, and significantly tech, any change to the long-term fed funds price estimate on the subsequent Fed conferences might be scrutinized. A change would have a extra materials impression on earnings and the outlook for equities, as a consequence of a persistently greater financing and low cost price, than the Fed’s short-term hawkishness.

European Corporations: Structural Drivers Are a Differentiator

In Europe, investor sentiment might have handed peak pessimism. Boosting confidence is that after Gazprom (OTC:GZPMF) introduced that it will completely reduce gasoline to Germany via the Nordstream pipeline, Russia doesn’t have a lot financial leverage left with its power. Following an Worldwide Financial Fund warning that Germany was liable to shedding 4.8% of financial output with out pure gasoline from Russia, power cooperation throughout Europe elevated.9 France and Germany, for instance, struck a deal to share power assets.

Additionally, in a coverage reversal, Germany moved to maintain two nuclear crops accessible this winter as European leaders scrambled for emergency fixes to the deepening power disaster. The transfer was one other instance of the strengthening funding case for nuclear power, one of many important long-term alternate options to fossil fuels from a scalability standpoint. The Solactive World Uranium & Nuclear Parts Whole Return v2 Index, which tracks uranium mining and corporations producing of nuclear elements, elevated 8.8% as of September 21.10

The Worldwide Atomic Power Company (IAEA) predicts that nuclear energy capability for electrical energy era grows 17% over the subsequent decade.11 Over the subsequent three years, uranium provide deficits ought to attain the US$4–16 million vary yearly.12 Additionally, demand for nuclear elements ought to improve steadily with the rising variety of nuclear reactors below development. Globally, there are 437 energetic reactors, 59 reactors at the moment below development, and an extra 89 reactors deliberate.13

Europe’s power disaster is now not a cyclical tailwind for these renewable and clear power themes, however a structural change. The area is transferring quick to an impartial power mannequin that requires a mixture of renewable sources and infrastructure to distribute power effectively throughout the member states, and corporations are stepping up. Roughly 15% of capital expenditures by main power firms are anticipated to help the inexperienced transition this yr. By 2030, the share is predicted to be over 50% in keeping with Bloomberg analyst forecasts.14

The European renewable producers and cleantech firms that present the expertise to provide different sources of power are more likely to proceed to see stronger demand from the area and the U.S. following the Inflation Discount Act’s passage. Supported by structural drivers, the European tech, power, and utilities firms that produce the services and products for the clear power transition outperformed their friends this yr as of 13 September 2022. As well as, we anticipate progress within the clear power sector to have a snowball impact on investments in disruptive supplies comparable to lithium, copper, cobalt, zinc and different uncommon earth supplies, that are essential inputs to scrub applied sciences.

Buyers are more and more on board as effectively. With US$1.3 billion year-to-date, local weather change themes are dominating UCITS thematic inflows.15 The biggest inflows amongst clear power subthemes are to hydrogen. We anticipate themes like wind and photo voltaic to garner increasingly curiosity within the coming months following the U.S.’ passage of the Inflation Discount Act, which incorporates over US$120bn for wind and photo voltaic via tax credit.16 These renewables are the most important portion of spending from its unprecedented local weather package deal. The Photo voltaic theme, captured by the Solactive Photo voltaic Index, is one of the best performing theme since Russia invaded Ukraine in February, rising 11.5% from February 17 to September 22.17

Silver Miners: Defensive Tilt Plus Structural Increase Is Engaging

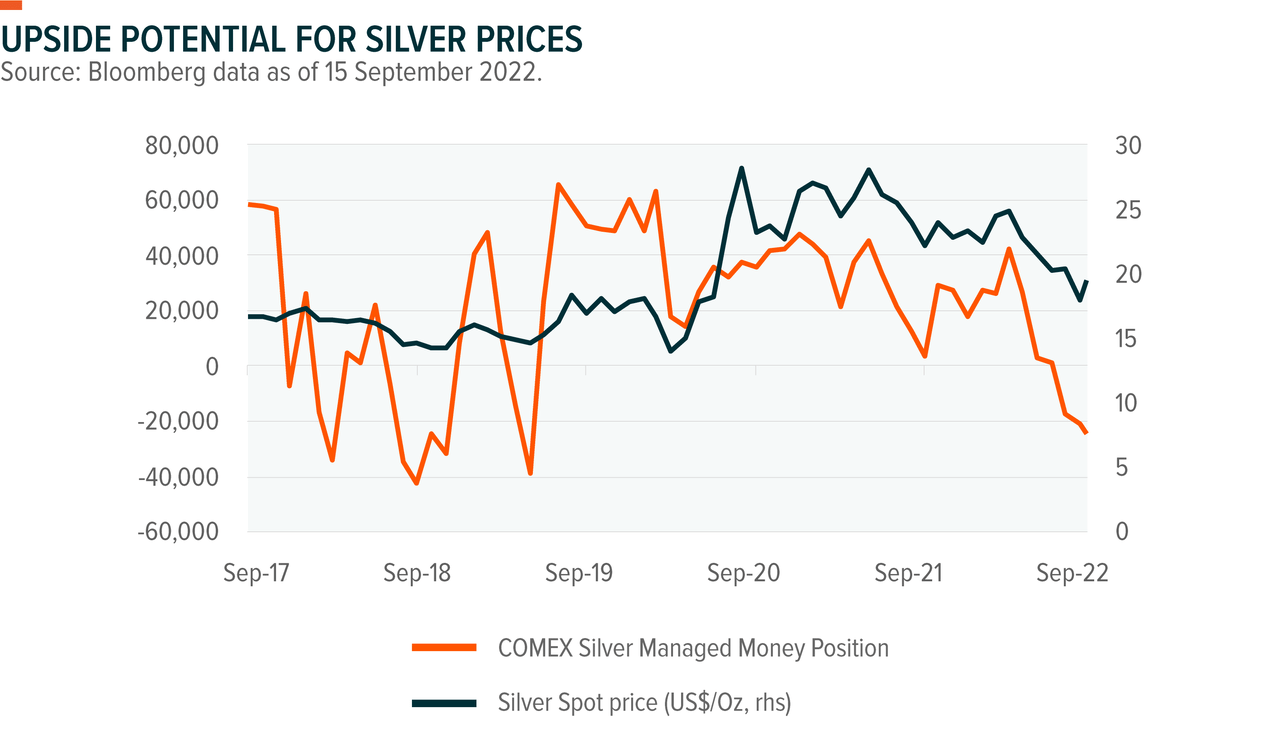

Silver is used to make photovoltaic (PV) cells, so photo voltaic enjoying main roles in Europe’s clear power transition and the Inflation Discount Act create structural tailwinds. Gold and silver have confronted headwinds for the reason that starting of the yr, however the extra secure U.S. greenback that we anticipate within the coming months ought to take away a few of these headwinds. When the economic system slows, silver tends to do effectively in the course of the downturn or simply after.

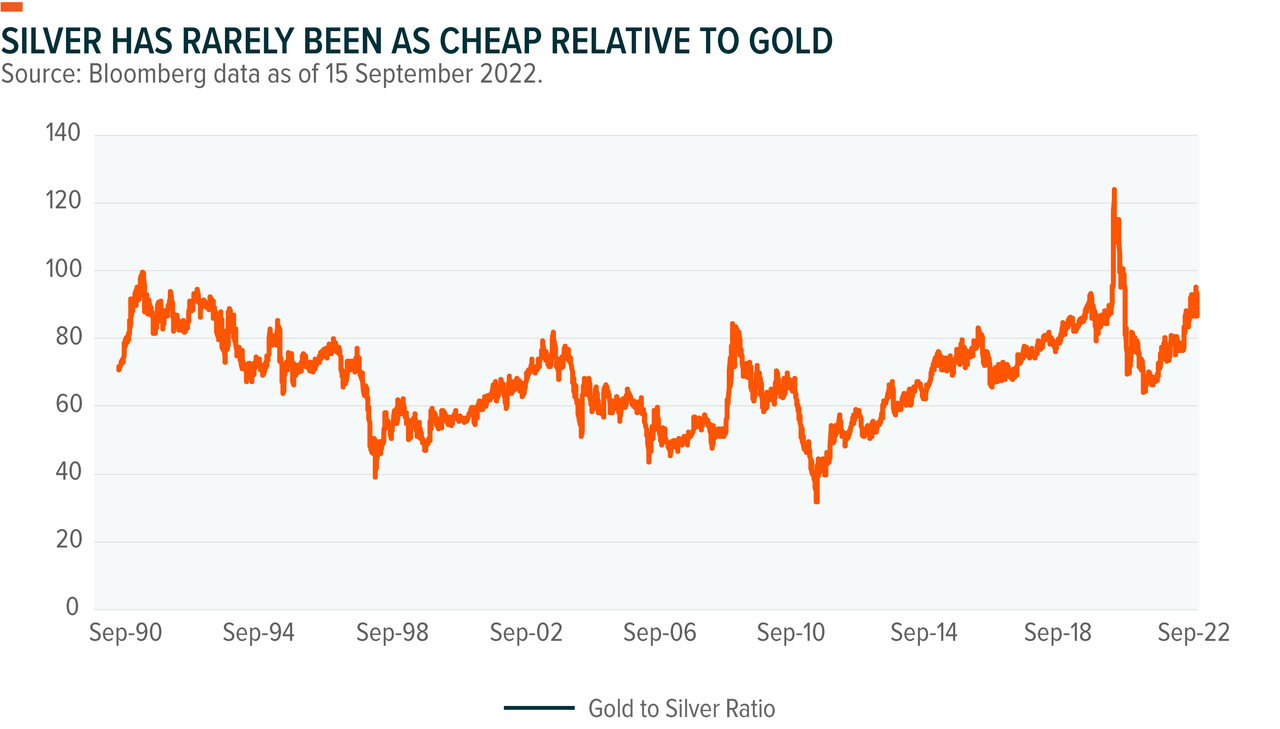

At present, the gold-to-silver ratio lingers close to 90, which signifies that it takes 90 ounces of silver to purchase one ounce of gold, effectively above its long-term common of 68.18 The upper the ratio, the extra undervalued silver is relative to gold. The ratio sometimes rises throughout treasured metals bear markets and falls throughout bull markets as a result of silver is extra unstable than gold. Silver has hardly ever been as low-cost in comparison with gold. Primarily based on historic developments, ought to treasured metals enter a bull market, this ratio might tighten considerably with silver costs rising greater than gold.

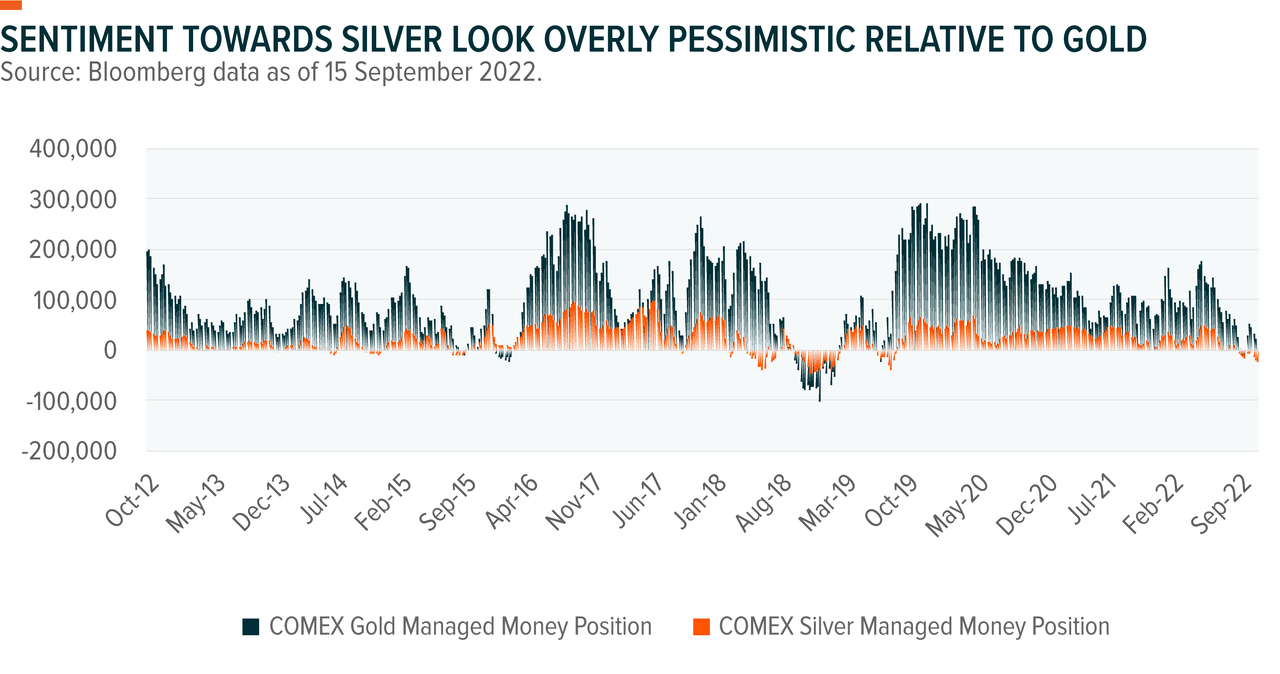

During the last 5 years, when internet speculative place went damaging, silver costs rebounded 4% on common within the following 2–3 months.19

Whereas silver costs at the moment are at their five-year common, silver miners’ inventory costs look undervalued. The common price-to-earnings ratio for silver miners is 17% decrease than its five-year common of 30x versus 36x.20 Silver miners’ fundamentals are higher than their inventory costs recommend. Regardless of the massive drop in silver costs and surging inflationary prices that made for a difficult Q2 2022, silver mining earnings remained comparatively strong with gross sales progress of 6.3% year-over-year (yoy) and a revenue margin of 5.7%.21

The income estimate for the businesses within the Solactive World Silver Miners Whole Return v2 Index is down 3.7% yoy for 2022, however analysts predict a powerful rebound in 2023 to 22.4% yoy.23 At present, the mixture score of market sentiment for silver miners is 4.3, build up from its pre-pandemic degree of three.9.22 This score ranges between 1 and 5, with 5 a bullish sign and 1 a bearish sign.

Silver mining shares supply leverage as a result of they have a tendency to outperform the steel when costs rise and underperform when costs decline. The primary set off for a breakout to the upside can be a marked financial slowdown, a situation that appears more and more possible within the medium time period.

Footnotes

1. ECB Workers. (2022, September 8). Macroeconomic projections for the Euro space. European Central Financial institution. ECB employees macroeconomic projections for the euro space, September 2022

2. Ibid.

3. Federal Reserve. (2022, September 21). FOMC Press Convention September 21, 2022 [Video]. YouTube. FOMC Press Convention September 21, 2022

4. Schectman, J., & Lawder, D. (2022, July 24). U.S. economic system slowing, however recession not inevitable, Yellen says. Reuters. U.S. economic system slowing, however recession not inevitable, Yellen says

5. Bloomberg, L. P. (n.d.). [NVIDIA and Meta dropped 45.9% and 31.6% respectively year-to-date]. Information as of and retrieved on September 22, 2022 from World X Bloomberg Terminal.

6. Bloomberg, L. P. (n.d.). [Fed funds futures pricing]. Information as of and retrieved on September 22, 2022 from World X Bloomberg Terminal.

7. Bloomberg, L. P. (n.d.). [Overnight Index Swap pricing]. Information as of and retrieved on September 22, 2022 from World X Bloomberg Terminal.

8. Bloomberg, L. P. (n.d.). [Data set]. Information as of and retrieved on September 22, 2022 from World X Bloomberg Terminal.

9. Dezem, V., Wilkes, W., & Delfs, A. (2022, August 1). Germany has three months to avoid wasting itself from a winter gasoline disaster. BNN Bloomberg. Germany Has Three Months to Save Itself From a Winter Fuel Disaster – BNN Bloomberg

10. Bloomberg, L. P. (n.d.). [Data set]. Information as of and retrieved on September 21, 2022 from World X Bloomberg Terminal.

11. Gospodarczyk, M. M. (2021, June 24). Nuclear energy proves its very important position as an adaptable, dependable provider of electrical energy throughout COVID-19. Worldwide Atomic Power Company. Nuclear Energy Proves its Important Function as an Adaptable, Dependable Provider of Electrical energy throughout COVID-19

12. UxC. (2021, August). Uranium manufacturing value research. UxC Particular Report. https://www.uxc.com/p/merchandise/pdf/TOC-UPCS.pdf

13. World Nuclear Affiliation. (2022, September). World nuclear energy reactors & uranium necessities. World Nuclear Energy Reactors | Uranium Necessities | Future Nuclear Energy – World Nuclear Affiliation

14. Bloomberg, L. P. (n.d.). [Data set]. Information as of and retrieved on July 13, 2022 from World X Bloomberg Terminal.

15. World X ETFs thematic classification with info derived from: Bloomberg, L. P. (n.d.). [Data set]. Information as of and retrieved on September 14, 2022 from World X Bloomberg Terminal.

16. Platts, Financial institution of America. (2022, September 9). World Analysis estimates.

17. Bloomberg, L. P. (n.d.). [Data set]. Information as of and retrieved on September 21, 2022 from World X Bloomberg Terminal.

18. Ibid.

19. World X ETFs calculations with info derived from: Bloomberg, L. P. (n.d.). [Data set]. Information as of and retrieved on September 15, 2022 from World X Bloomberg Terminal. Notice: The pre-pandemic degree of three.9 is as of September 2019.

20. Ibid.

21. Ibid.

22. World X ETFs calculation with info derived from: Bloomberg, L. P. (n.d.). [Data set]. Information as of and retrieved on September 21, 2022 from World X Bloomberg Terminal. Notice: The consensus of analysts from Bloomberg (ANR) consolidates market-wide analyst suggestions for the chosen equities into aggregated scores. This aggregated score is at 4.3 for the Solactive World Silver Miners Whole Return v2 Index (portfolio weighted common).

23. World X ETFs calculation with info derived from: Bloomberg, L. P. (n.d.). [Data set]. Information as of and retrieved on September 22, 2022 from World X Bloomberg Terminal.

Investing includes threat, together with the attainable lack of principal. Worldwide investments might contain threat of capital loss from unfavorable fluctuation in foreign money values, from variations in usually accepted accounting ideas, or from financial or political instability in different nations. Rising markets contain heightened dangers associated to the identical elements in addition to elevated volatility and decrease buying and selling quantity. Securities specializing in a single nation and narrowly targeted investments could also be topic to greater volatility. The World X Worldwide Entry Suite Funds are non-diversified.

Shares of ETFs are purchased and offered at market worth (not NAV) and are usually not individually redeemed from the Fund. Brokerage commissions will cut back returns.

The worth of an funding in ETFs might go down in addition to up and previous efficiency will not be a dependable indicator of future efficiency.

Buying and selling in ETFs will not be appropriate for every type of traders as they carry a excessive diploma of threat. You could lose your whole preliminary funding. Solely speculate with cash you may afford to lose. Modifications in alternate charges might also trigger your funding to go up or down in worth. Tax therapy will depend on the person circumstances of every shopper and could also be topic to alter sooner or later. Please be certain that you totally perceive the dangers concerned. If in any doubt, please search impartial monetary recommendation. Buyers ought to consult with the part entitled “Threat Components” within the related prospectus for additional particulars of those and different dangers related to an funding within the securities provided by the Issuer.

This materials represents an evaluation of the market atmosphere at a selected time limit and isn’t meant to be a forecast of future occasions, or a assure of future outcomes. This info will not be meant to be particular person or personalised funding or tax recommendation and shouldn’t be used for buying and selling functions. Please seek the advice of a monetary advisor or tax skilled for extra info relating to your funding and/or tax state of affairs.

Fastidiously take into account the funds’ funding targets, dangers, and expenses and bills. This and different info might be discovered within the funds’ full or abstract prospectuses, which can be obtained at globalxetfs.com. Please learn the prospectus rigorously earlier than investing.

World X Administration Firm LLC serves as an advisor to the World X Funds.

Authentic Put up

Editor’s Notice: The abstract bullets for this text have been chosen by In search of Alpha editors.