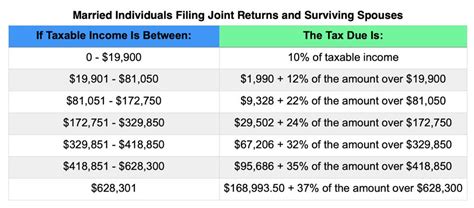

Did 2022 Tax Brackets Change. For 2022, they're still set at 10%, 12%, 22%, 24%, 32%, 35% and 37%. Here's how they apply by filing status:

So, what are the 2022 changes? 2022 tax bracket and tax rates. 20.5% on the portion of taxable income over $49,020 up to $98,040 and.

However, The Tax Brackets Have Been Adjusted To Account For Inflation.

However, the tax brackets are adjusted (or indexed) each year to account for inflation. Let’s take a look at the 2022 tax brackets, and compare them to the 2021 and 2017 brackets to see how the trump tax plan could have affected your. Since 2018, the employee and employer taxes for cpp have increased from $2,594 in 2018 to $3,500 in 2022.

Here's How They Apply By Filing Status:

And, tax brackets (which taxpayers can use to determine their income taxes) also change annually. See the latest tables below. The law created new income tax brackets that changed what many americans pay in taxes.

Federal Tax Bracket Rates For 2022.

20.5% on the portion of taxable income over $49,020 up to $98,040 and. Most changes went into effect on jan. As of january 1, 2022, washington, d.c.’s individual income tax changed considerably.

Taxable Income Up To $20,550 (Up From $19,900 For 2021)

Final 2022 tax brackets have now been published by the irs and as expected (and projected) federal tax brackets have expanded, while federal tax rates stayed the same. After the standard deduction, or other itemized deductions and tax breaks have been taken, here's how your income will be taxed. For 2022, they're still set at 10%, 12%, 22%, 24%, 32%, 35% and 37%.

The Irs Adjusts Income Thresholds Annually For Inflation.

15% on the first $49,020 of taxable income, and. The irs says it will change the tax brackets, which is the range of incomes subject to a certain income tax rate for 2022. And the standard deduction is increasing to $25,900 for married couples filing together and $12,950 for.