Ky Tax Brackets 2022. The federal income tax brackets for tax year 2021 can be found here. Kentucky's maximum marginal corporate income tax rate is the 10th lowest in the united states, ranking directly below missouri's 6.250%.

Medicare tax, which is 1.45% of each employee’s taxable wages up to $200,000 for the year. Under sb 133 and effective in 2022, each county is authorized to set by ordinance or resolution, a county income tax rate equal to at least 2.25% (previously, 1%) and to apply the county income tax on a bracket basis. Employers have to pay a matching 1.45% of medicare tax, but only the employee is responsible for paying the 0.9% additional medicare tax.

Residents Must Complete Returns On Form 740 By April 15.

No standard deductions and exemptions Incomes greater than $539,900 for single filers and $647,850 for joint filers: Taxable income between $89,075 to $170,050.

We Will Update This Page With A New Version Of The Form For 2023 As Soon As It Is Made Available By The Kentucky Government.

Taxable income between $41,775 to $89,075. Kentucky income tax 2022 withholding tax tables computer formula revised december 2021 effective for tax year beginning january 1, 2022 commonwealth of kentucky department of revenue frankfort 42a003(t) These numbers are subject to change if new kentucky tax tables are released.

Taxable Income Up To $10,275.

Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower Medicare tax, which is 1.45% of each employee’s taxable wages up to $200,000 for the year. Kentucky's maximum marginal corporate income tax rate is the 10th lowest in the united states, ranking directly below missouri's 6.250%.

2022 Tax Brackets And Rates.

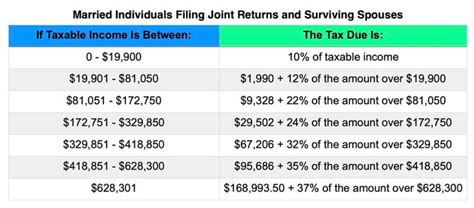

Detailed kentucky state income tax rates and brackets are available on this page. Kentucky collects a state corporate income tax at a maximum marginal tax rate of 6.000%, spread across three tax brackets. The federal income tax rates for 2022 will be:

We Last Updated Kentucky Schedule Itc In January 2022 From The Kentucky Department Of Revenue.

Compare state tax brackets, rates Both the sales and property taxes are below the national averages, while the state income tax is right around the u.s. 2022 kentucky tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.