Llc Tax Filing Dates. If the donor died during 2020, form 709 must be filed not later than the earlier of: This means you file your business taxes at the same time you file your personal income taxes.

If your llc does not owe any taxes, there will be no fee for filing late no matter what filing status you choose. Partnership tax returns on form 1065: These businesses typically file their taxes annually.

If Your Llc Does Not Owe Any Taxes, There Will Be No Fee For Filing Late No Matter What Filing Status You Choose.

This means you file your business taxes at the same time you file your personal income taxes. Does my california llc need to file form 3536 (estimated fee for llcs) in the 1st year? These businesses typically file their taxes annually.

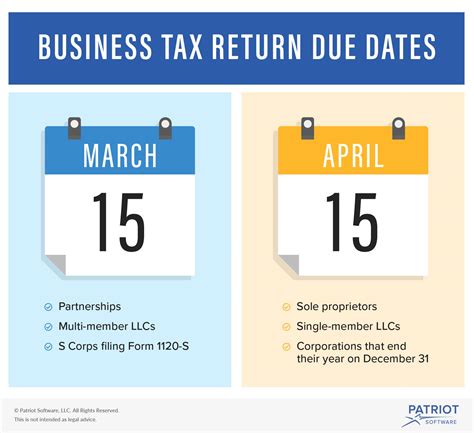

Llcs Taxed As Partnerships Should File Form 1065 By March 15, 2019, On A Calendar Tax Year.

Deadline for employees who earned more than $20 in tip income in september to report this income to their employers. The due date (with extensions) for filing the donor’s estate tax return; Llc members should also keep in mind the date to file form 1040 with schedule e attached.

April 15, 2021, Or The Extended Due Date Granted For Filing The Donor’s Gift Tax Return.

Generally, an election specifying an llc’s classification cannot take effect more than 75 days prior to the date the election is filed, nor. You don’t have to file your return yet, but your estimated payment must be postmarked by this date. Partnership tax returns on form 1065:

You Do Not Need To File Any Separate Paperwork For The Llc Itself.

All of the income and expenses from your llc are reported on your personal tax return, which is due on april 15. Or, file it by the 15th of the third month after the tax year ends if you file taxes on a fiscal year basis. For llcs that are taxed as a corporation or single member llcs, the tax deadline is april 15, 2022.

The Total Penalty Will Not Exceed 25% Of Your Unpaid Taxes.

The best tax treatment option maximizes your tax savings when you file your small business taxes. For llcs that are taxed as a partnership, the tax deadline is march 15, 2022. For an llc that has just been founded, the due date is three months after the llc was founded.