California Tax Filing Dates. On this page we have compiled a calendar of all sales tax due dates for. Beware of scams as new tax season begins (january 12, 2022) filing season tax tips (january 5, 2022) franchise tax board hero receives state’s highest honor for public servants (december 24, 2021) october 15 tax deadline approaching to file and claim the golden state stimulus (october 8, 2021)

First day to file the business property statement, if required or requested, with your county assessor (last. The penalty for late payment of tax is 10 percent (0.10) of the amount of tax due together with interest on the tax from the date on which the tax is due and payable until the date of payment. Between lien date and april 1:

Employers Are Required To Report Specific Information Periodically.

Lien date for all taxable property. California earned income tax credit (caleitc) californians with income up to $30,000 may qualify for caleitc. However, you don't have to make a.

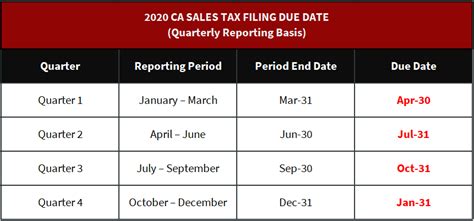

Calendar Of California Sales Tax Filing Dates.

Required filings and due dates. Between january 1 and june 1: Send us your payment if you are not ready to file your return.

First Day To File Property Statement With Assessor If Required Or Requested.

(optionally, the efileit* deadline is oct. You must file and pay by april 18, 2022. Review the following to learn about your requirements for filing income tax, payroll tax, sales and use tax, and more.

This Is Also The Deadline To Request An Automatic Extension (Form 4868) For An Extra Six Months To File Your Return, And For Payment Of Any Tax Due.

Filing period original due date extension due date; Find your filing frequency below for your due dates. First day to file the business property statement, if required or requested, with your county assessor (last.

January 18 Is The Last Day For Most People To Pay Estimated Taxes For The 4Th Quarter Of 2021.

The golden state did the same for state income tax filing. First day to file claim for homeowners’ or disabled veterans’ exemption. Tax day is april 18 for filing 2021 taxes, plus how to apply for an extension on your return.