Advice on 2020 tax returns and stimulus check. All these were advance payments of the credit;

COVID19 Stimulus Check Calculator 2020

A new year stimulus check worth up to $1,400 will be sent out to some americans early on in 2022.

Stimulus check 3 goes off what tax year. If your situation changed dramatically between. Any individuals who saw their income climb above the $80,000 threshold last year may want to wait to file their tax return until biden signs. The tax collection agency also faces the prospect of distributing a third round of stimulus checks, as president joe biden comes into office and.

For most people, it won’t make a difference which year’s tax returns the irs uses. The amount of your third stimulus check is based on your 2019 or 2020 taxes, whichever the irs has on file at the time it determines your payment. If you're one of 22 million americans who lost a job during the pandemic, you could benefit from having the third stimulus payment based on your 2020 tax filing.

If your 2020 income was below $80,000 for single filers and $160,000 for joint filers, you would be eligible for some amount of the potential third. The proposal from the house ways and means committee gives $1,400 for each dependent. The third round of stimulus checks are based on your most recent tax filing with the irs but are an advanced payment on a refundable tax credit for 2021.

You should note that if your income fell in the 2020 tax year, filing your tax return earlier could help you qualify for a bigger third stimulus check. For tax filers with income above these amounts, the stimulus payment decreases by $5 for each $100 above the thresholds. The stimulus check rebate completely phases out at $99,000 for single taxpayers, $136,500 for those filing as head of household and $198,000 for joint filers with no kids.

But there is one circumstance where you would want the irs to use your 2019 tax return — which. In that third round of economic impact payments (eip. The measure includes $1,400 stimulus checks for many americans, extended unemployment benefits at $300 a week through sept.

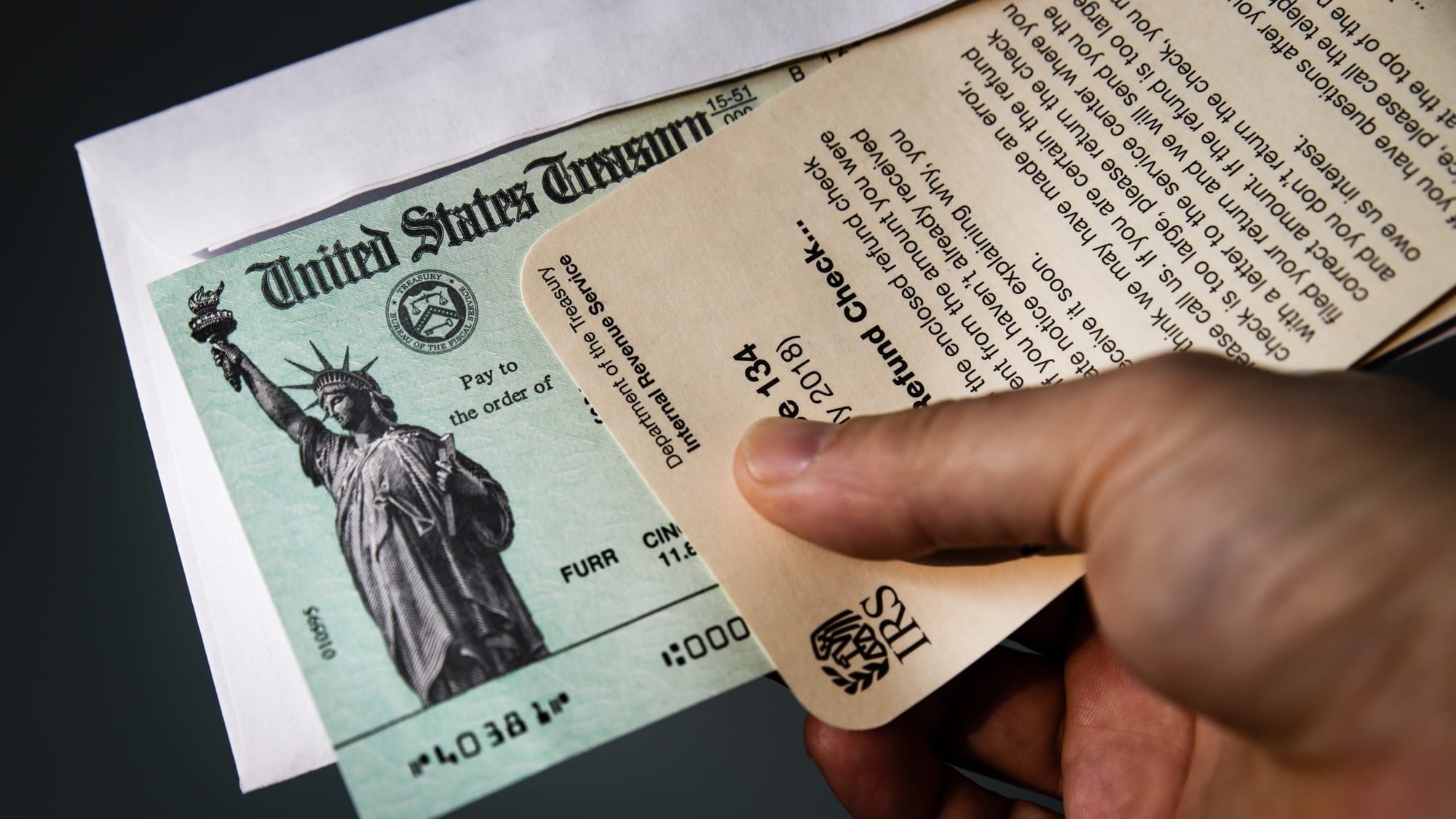

That means if you haven’t filed your 2020 return yet, the irs has your 2019 return to go off. Single filers earning an adjusted gross income (agi) up to $75,000 and heads of household earning up to. The third stimulus checks were mailed by the federal government between march and december 2021, following passage of the american rescue plan.

The third economic impact payment is worth up to $1,400 per individual and dependent. If you did not receive your third stimulus check, this is to be claimed on your 2021 tax return as the recovery rebate credit or rrc.this refundable tax credit was introduced in 2020 and was composed of stimulus one and two; Retired workers could be in line for a $1,400 stimulus check credit:

So these checks will also be based on the last information the irs has on you,” he added. The 2022 payments will go out to people who were eligible for the third round of stimulus checks that went out earlier this year, but haven't yet received them. If you got advanced child tax credit payments, you’ll need the letter when you file your taxes for tax year 2021 in 2022.

That increase though could push many retired workers into a higher tax bracket, and the possible. Under the current proposal, the amount for the third stimulus check would be phased out, reaching zero at $100,000. Couples filing jointly would get a total of $2,800 if they made up to $150,000.

$1,400 relief payments would go to individuals making $75,000 or less, while couples earning $150,000 would be entitled to $2,800 relief payments. The 2021 credit is only stimulus three. The rise will mean retirees will pocket a rise of $92 a month.

That means some people may want to file their tax return after the latest covid bill is passed and any stimulus goes out, so the payment is calculated using their 2019 information. Which tax return is used for my third stimulus check? Claim your 2021 recovery rebate credit when you prepare.

The irs uses 2019 or 2020 tax returns to determine eligibility for your third stimulus check. The amount your will receive from a 3rd stimulus check begins to gradually decrease for individuals and married couples who earn more than $75,000, $112,500, or $150,000 until being phased out entirely at $80,000 for individuals, $120,000 for heads of household, and $1600,000 for married couples filing jointly. Your eligibility will be based on information from.

They’ll qualify for the full stimulus check either way. So if you welcomed a child in 2020, but your stimulus payment is going off your 2019 taxes, you might miss out.

4th stimulus check confirmed by Joe Biden Amount and

Next Stimulus Check 8 Things to Know

Third Stimulus Checks Delayed? 1400 Payments Still Coming

9 Million Americans Have Until October 15 To Claim Their

Haven't Filed Taxes In 3 Years Will I Get Stimulus Check

Stimulus Check 3 Tax Year / Second stimulus check How

Can someone help pls! This is my first year filing! Didn’t

IRS Warns Consumers of Stimulus Check Scams

Stimulus check Should you file your taxes early to get

The 1,400 Stimulus Check For SSDI & Veterans How & When

You could have more than 1 stimulus check. Here's how you

Stimulus Check Almost A Sure Thing For Those Making Under

1,400 third stimulus check what is "IRS TREAS 310 TAX

Stimulus Checks Are on Their Way—Tips for Stretching Your

IRS Sends Out 90 Million Stimulus Checks in 1 Week—3 Times

2,000 Monthly STIMULUS CHECK in Next Stimulus Package

The Moneyist ‘I was discarded after 40 years of marriage