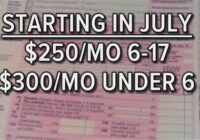

Economic Stimulus Child Tax Credit

Economic Stimulus Child Tax Credit. Most eligible families have been able to receive half of their 2021 child tax credit money in advance due to changes in 2021 to the us child tax credit. Andy phillips, director at the tax institute at h&r block told local 12 that parents who meet eligibility requirements would receive $3,600, thanks to… Read More »