Child Tax Credit 2022 Who Qualifies

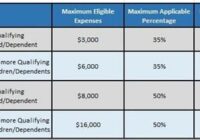

Child Tax Credit 2022 Who Qualifies. According to the irs website, working families will be eligible for the whole child tax credit if; Currently, parents can receive up to $3,600 for every child under 6 and $3,000 for kids between 6 and 17. Child tax credit 2022 update Surprise 1,200 may be from racepack.sg They earn $150,000 or… Read More »