Tax Brackets For 2022. Marginal tax rates for 2022 will not change but the level of taxable income that applies to. However, the tax brackets have been adjusted to account for inflation.

There are seven tax rates in 2022: Marginal tax rates for 2022 will not change but the level of taxable income that applies to. In 2021, the income limits for all tax.

20.5% On The Portion Of Taxable Income Over $49,020 Up To $98,040 And.

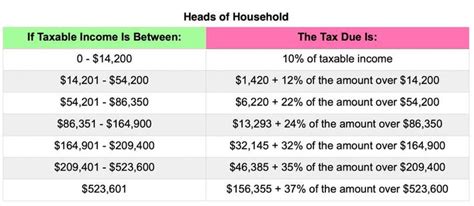

Here are the new brackets for 2022, depending on your income and filing status. 2022 federal income tax brackets and rates in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). The rateucator calculates what is outlined here for you.

Get Help Understanding 2022 Tax Rates And Stay Informed Of Tax Changes That May Affect You.

You can see also tax rates for the year 202 1 and tax bracket for the year 20 20on this site. The 2022 financial year starts on 1 july 2021 and ends on 30 june 2022. These are the 2021 brackets.

However, The Tax Bracket Ranges Were Modified Based On Inflation.

In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose. Note that the tax foundation is a 501(c)(3) educational nonprofit and cannot answer specific questions about your tax situation or assist in the tax filing process. For the 2022 tax year, there are also seven federal tax brackets:

Use The Tool Above To See A.

15% on the first $49,020 of taxable income, and. For 2022, they're still set at 10%, 12%, 22%, 24%, 32%, 35% and 37%. These are the rates for taxes due in april 2023.

The Irs Changes These Tax Brackets From Year To Year To Account For Inflation And Other Changes In Economy.

26% on the portion of taxable income over $98,040 up to $151,978 and. We've listed these for 2021 and 2022 below. The personal exemption for tax year 2022 remains at 0, as it was for 2021, this elimination of the personal exemption was a provision in the tax cuts and jobs act.