What Tax Year Does Fafsa Use For 2022. 2020 the fafsa questions about untaxed income, such as child support, interest income, and. And in a year where change feels near constant, the fafsa application has undergone a few.

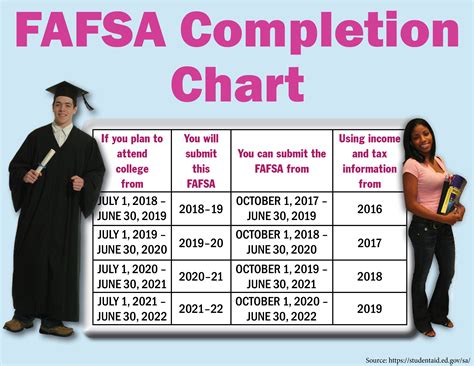

You cannot substitute 2020 income and tax information. When counting assets, the fafsa uses the current value of your and your child’s assets. The dates on the fafsa refer to the academic year for which you plan to attend.

The Prior Year (Py) Is The Tax Year Before The Academic Year.

When counting income, the fafsa uses information in your tax return from two years earlier. Students must complete the form for each year they wish to receive aid. The free application for federal student aid (aka fafsa) opens oct.

Or Apply Free Online At.

When counting income, the fafsa uses information in your tax return from two years earlier. When counting income, the fafsa uses information in your tax return from two years earlier. Data from the completed tax year is used as a predictor of the family’s financial situation for the current year.

When Quantifying Your Income, The Fafsa Uses Information In Your Tax Return From Two Years Prior.

2020 the fafsa questions about untaxed income, such as child support, interest income, and. Use the irs data retrieval tool when possible to automatically import your tax information into your fafsa. What tax year does fafsa use for 2022 2023?

You Cannot Substitute 2020 Income And Tax Information.

When counting assets, the fafsa uses the current value of your and your child’s assets. And in a year where change feels near constant, the fafsa application has undergone a few. Since the irs tax return transcript does not have line or item numbers and uses wording that may.

What Semester Does Fafsa 2020/21 Cover?

If you are applying for. When counting income, the fafsa uses information in your tax return from two years earlier. When quantifying your income, the fafsa uses information in your tax return from two years prior.