2022 Tax Brackets Vs 2022. Tax brackets for income earned in 2022 37% for incomes over $539,900 ($647,850 for married couples filing jointly) 35% for incomes over $215,950 ($431,900 for married couples filing jointly) The alternative minimum tax exemption amount for the 2022 tax year is $75,900, up from $73,600 this year.

Domestic company marginal basic threshold in 2022 ₹ 1,00,00,000 The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to $10,275.

Tax Brackets For Income Earned In 2022 37% For Incomes Over $539,900 ($647,850 For Married Couples Filing Jointly) 35% For Incomes Over $215,950 ($431,900 For Married Couples Filing Jointly)

10%, 12%, 22%, 24%, 32%, 35% and 37%. Domestic company higher tax threshold in 2022: Tax brackets for income earned in 2022 37% for incomes over $539,900 ($647,850 for married couples filing jointly) 35% for incomes.

2022 Tax Brackets And Rates In 2022, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

The standard deduction increased over 3% for all filing status’. 2022 tax brackets (taxes due april 2023 or october 2023 with an extension) tax rate 10 percent, 12 percent, 22 percent, 24.

The Irs Changes These Tax Brackets From Year To Year To Account For Inflation And Other Changes In Economy.

For example, the 22% tax bracket for the 2021 tax year goes from $40,526 to $86,375 for single taxpayers, but. Final 2022 tax brackets have now been published by the irs and as expected (and projected) federal tax brackets have expanded, while federal tax rates stayed the same. For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing jointly).

Domestic Company Basic Tax Threshold In 2022 ₹ 10,00,00,000:

There are seven tax rates in 2022: The alternative minimum tax exemption amount for the 2022 tax year is $75,900, up from $73,600 this year. The 2022 standard deduction amounts are as follows:

As You Can See From The Chart, The Biggest Income Tax Rate Jump Goes From 24% To 32% When Your Income Is Between $170,051 To $215,950.

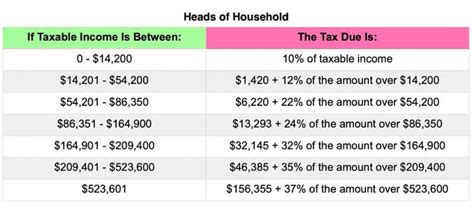

Federal tax brackets 2022 for income taxes filed by april 15, 2023 tax rate: The personal exemption for tax year 2022 remains at 0, as it was for 2021, this elimination of the personal exemption was a provision in the tax cuts and jobs act. Both the 2021 and 2022 tax bracket ranges also differ depending on your filing status.