2022 To 2022 Tax Brackets Us. The alternative minimum tax exemption amount for the 2022 tax year is $75,900, up from $73,600 this year. There are seven tax brackets for most ordinary income for the 2021 tax year:

Us news see links of interest The 2022 tax brackets for single filers. As was the case and due to trump’s tax cuts and jobs acts the the personal exemption remained $0 for tax year 2022.

The United States Annual Tax Calculator For 2022 Can Be Used Within The Content As You See It, Alternatively, You Can Use The Full Page View.

2022 income tax brackets, presumptive tax and other adjustments posted on january 3, 2022 january 6, 2022 by staff writer act no.7 of 2021, finance act has revealed what the income tax structure. In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). This tax table reflects the.

For Tax Year 2022, The Top Tax Rate Remains 37% For Individual Single Taxpayers With Incomes Greater Than $539,900 ($647,850 For Married Couples Filing Jointly).

Federal income tax brackets 2022. Tax brackets for income earned in 2022 37% for incomes over $539,900 ($647,850 for married couples filing jointly) 35% for incomes. Importantly, the 2021 brackets are for income earned in 2021, which most people will file taxes on before april 15, 2022.

Corporate Tax Rate In The United States Remained Unchanged At 21 Percent In 2021 From 21 Percent In 2020.

The tax year 2021 tax brackets and rates for filing in 2022 are as follows: In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to $10,275. The 2022 tax brackets for single filers.

For Tax Year 2022, The Standard Deduction Will Be:

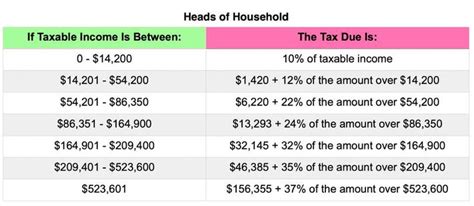

Your tax bracket depends on your taxable income and your filing status: There are seven tax brackets for most ordinary income for the 2021 tax year: 2021, 2022 tax brackets by filing status.

2022 Tax Brackets And Rates.

In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). See below for how these 2022 brackets compare to 2021 brackets. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly.