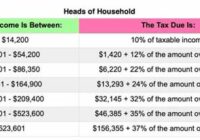

Dutch Tax Brackets 2022

Dutch Tax Brackets 2022. This page has been updated continuously during the parliamentary process to reflect the latest information and you can read the final result here. It is proposed to extend the lowest bracket from €245,000 to. Taxes 2022 Netherlands E Jurnal from ejurnal.co.id Tax tables in the netherlands are simply a list of the relevent tax… Read More »