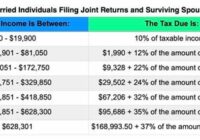

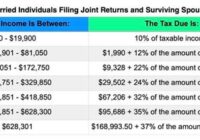

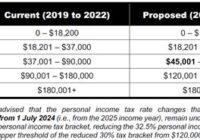

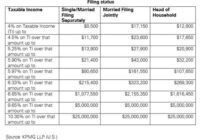

Tax Brackets 2022 Married Filing Separately

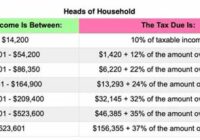

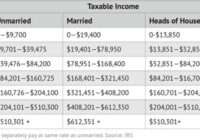

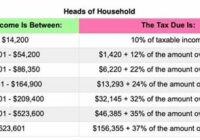

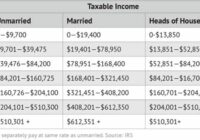

Tax Brackets 2022 Married Filing Separately. Tax rates 2022 married filing separately. In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to. Tax Brackets 2022 Utah Married Filing Jointly E Jurnal from guitarcollectioner.com 15% tax rate up to $517,200 Taxable income (married… Read More »