2022 Tax Brackets Roth Ira

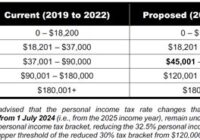

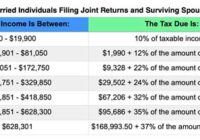

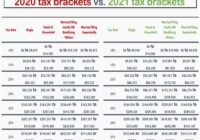

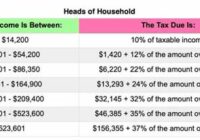

2022 Tax Brackets Roth Ira. 70% chance contributing or converting to a roth ira is the right choice; 30% chance contributing or converting to a roth ira is the right choice; 2019/20 Budget Individual Tax Changes from www.peerwealth.com.au Backdoor roth ira is one of the most important strategies pitched by whitecoat investor. Retirement calculator roth ira income limits… Read More »